Gray Divorce is on the Rise. Financial Planning Can Help.

February 12, 2020

By Dan DeMarest

By Dan DeMarest

Vice President of Wealth Management While divorce rates are trending downward for most of the population, there is one age group where divorces are actually increasing — those over the age of 50.

Many older couples aren’t aware of the legal implications and everyday consequences of divorce later in life. Some of the most troubling issues involve health care, insurance, retirement savings, Social Security and taxes. In this article, we’ll discuss what gray divorce is, and how preparing financially now can help you reduce the impact of gray divorce later — or hopefully avoid it altogether.

What is gray divorce?

The term “gray divorce” refers to divorce among older adults — especially baby boomers — who have been married for an extended period of time. When the definition first surfaced, it was assumed anyone married for that long was probably older with grayer hair, hence the term “gray” divorce. Today, however, the phrase generally relates to the higher divorce phenomenon for adults over the age of 50, regardless of the color of their hair.

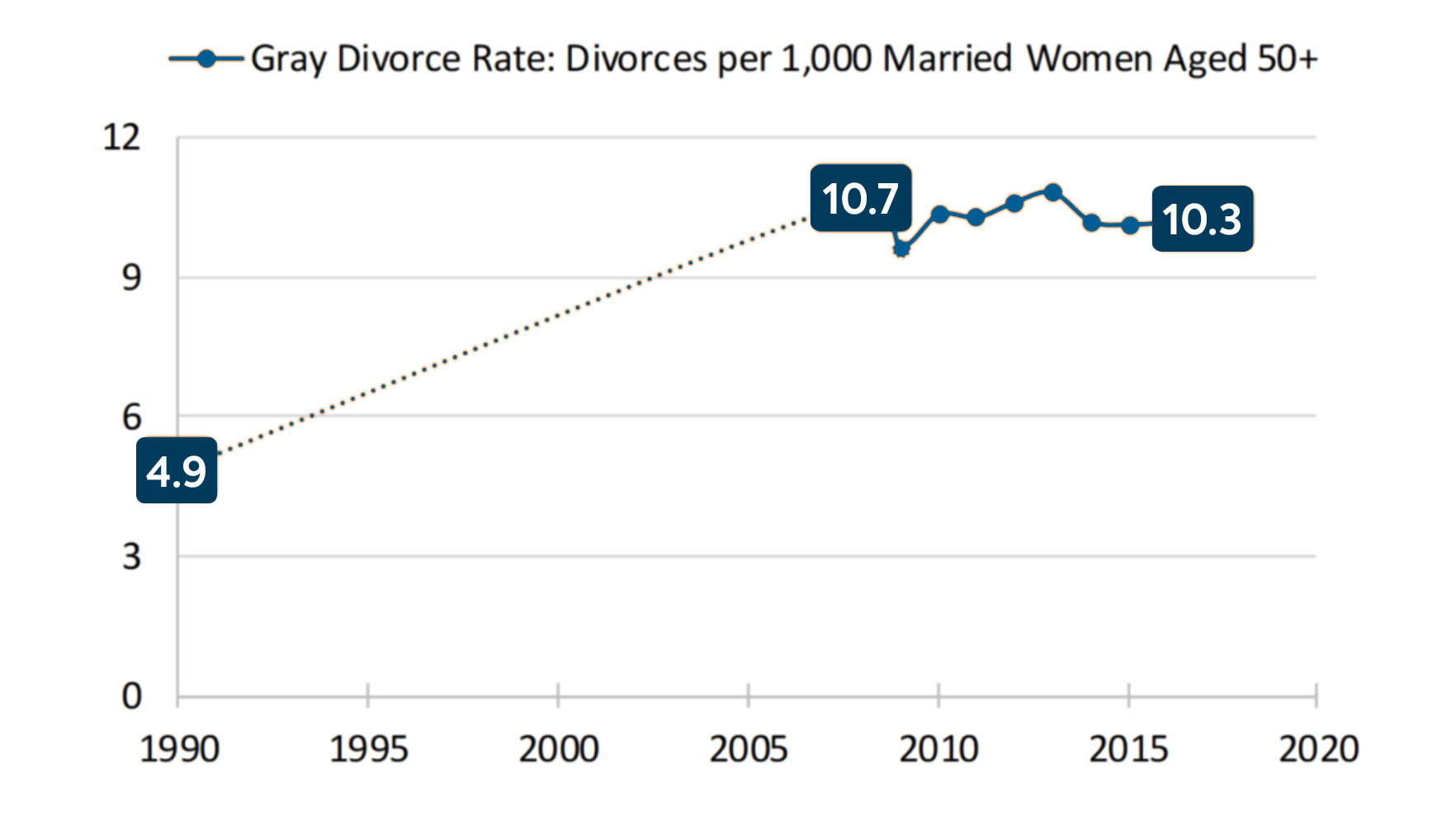

In fact, while divorce among young adults is becoming less common, according to Pew Research, divorce among older generations is on the rise. Since 1990, the divorce rate for adults 50 and over has nearly doubled — and more than doubled for women:

Source: National Center For Family Marriage & Research

Reasons gray divorce is on the rise

Of course there are many reasons couples end their marriages, but scientists from the National Center for Family and Marriage Research have identified four main gray divorce factors driving the rising trend in older adults.

1. The divorce echo effect.

The statistics don't lie: “Remarriages” are more likely to end than first marriages. Why? Research shows that once a spouse has already gone through a divorce, they are more willing to end their second or third marriage if they feel dissatisfied. And as common sense (and Pew Research) tell us, remarriages tend to involve older adults.

2. Less social stigma.

The NCFMR researchers explain that divorce is now seen as a more socially acceptable solution than it was decades ago. And because divorce carries less social stigma than in the past, spouses are more likely to call it quits if they're no longer feeling fulfilled in their marriage.

3. People are living longer.

With the advent of modern-day health care and health facilities, people are living much longer than their ancestors. Men and women over the age of 50 and 60 can expect to live another 20 to 30 years — which, many research subjects say, is a long time to stay in an unpleasant marriage. Due to the larger number of divorced people in the population, opportunities for older adults in their 50’s, 60’s and 70’s to meet new partners are more prevalent and widespread than in previous generations. In fact (and maybe surprisingly), online dating is growing among older adults.

4. Women at work.

Over the last several decades, the number of females in the workforce has increased substantially. This development offers women, in particular, a unique opportunity to support themselves outside of marriage. Generally, women of past eras were financially dependent on their husband and did not have this option. What’s more? Research since the 1940’s has shown that women initiate divorce more than men. Why? It’s hard to pinpoint, since there is no specific evidence to show women today are more unhappy than women of the past, but one truth is self evident: modern women are certainly more financially independent.

How financial planning can help you avoid gray divorce:

Perhaps one of the biggest drivers of divorce is lack of communication about finances after retirement. It’s essential that couples spend time discussing each other’s expectations for retirement — such as when each partner would like to retire, where they would like to live, how they expect to support themselves and goals for later on in life. It’s these conversations that can help couples navigate the road ahead and maintain a healthy relationship. (If you need a starting point, set up an appointment with a financial advisor who can help initiate the conversation).

Approaching those tough conversations about money can be stressful, but financial discussions are well worth it for the health of your marriage. Discussing the topic of longevity and identifying your expectations for retirement — both materially and financially — can help couples avoid gray divorce altogether. According to a recent study conducted by the Institute for Divorce Financial Analysts, 22 percent of divorces are caused by money issues or money arguments. So before you become a statistic, try talking through some of these retirement points.

Question 1: When do we want to retire?

This might seem like an easy question, but time is money. When it comes to retirement, the age you’d like to retire is a direct factor of how much money you need to be saving. It is necessary that you and your partner are on the same page about what is attainable for retirement age so neither party ends up disillusioned.

Question 2: What do we want to do in retirement?

Couples that want to stay at home are going to require different financial means than couples who would like to travel the world after retirement. You and your spouse should discuss what you want to do with your retirement and think about how you will finance your adventures.

Question 3: What will our budget be in retirement?

Before retirement, you and your partner should analyze your finances and determine your maximum monthly budget based on your financial savings. Compare this monthly budget with your retirement goals to be sure you have enough money set aside for each spouse to live a full retirement.

Question 4: How do you feel about financial risk?

Talk with your spouse about their comfort level with financial risk. A healthy savings strategy includes a diversified portfolio of savings and investments, but as you get older, that balance of risk may shift. Understand what your other partner expects in terms of the stability of your savings and adjust your plan accordingly to fit both of your needs.

Don’t let gray divorce cast a shadow over your retirement

Whether or not you and your spouse have already thought about retirement, preparing for the milestone will be advantageous when the time comes. It’s important to examine your spending, your debts, your investments and your risk tolerance so you know exactly where you stand financially. Preplanning can help you prepare for the retirement of your dreams and ensure you spend it together.

If you’re ready to plan for that next step in life, set up a time to meet with one of our financial experts. Our team will work with you and your spouse to develop a post-retirement plan that aligns with your goals.