Mobile Check Deposit

Do you need to deposit a check, but don’t have time to make it to the bank? Deposit it right from your phone, using the SNB SD Mobile App. Just sign it, snap a picture with your phone camera and press a button to submit. It’s that easy.

How do I deposit a check with my phone?

Watch the video above, or read the step-by-step instructions below to learn how to deposit a check from your mobile device.

Step-by-step instructions

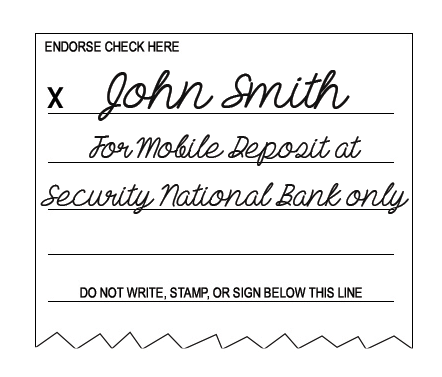

Step 1: Sign your check. You should use this exact wording:

{First/Last Name}

For Mobile Deposit at

Security National Bank only

See screenshot example

Step 2: Log in to the SNB SD Mobile App on your device. (click here to download).

Step 3: Tap the blue action button (+)

See screenshot example

Step 4: Tap Deposit and Continue.

See screenshot example

Step 5: Tap Front and photograph the front of your check. Keep the check within the white boundaries on your screen. For best results, place your check on a flat and dark surface.

See screenshot example

Step 6: Tap the green Check Mark if you like the photo (otherwise tap the red X to re-take the photo).

See screenshot example

Step 7: Tap Back and repeat the process with the back of your check.

See screenshot example

Step 8: Enter the check Amount, preferred account to Deposit To and your Email. Tap Continue.

See screenshot example

Step 9: Review your information. If it is OK, tap Approve. We’ll send you a verification email to confirm your check has been received, and another one when the check has processed.

Other Frequently Asked Questions:

Here's a list of Frequently Asked Questions (FAQs) and answers about our Mobile Check Deposit feature:

Who is eligible for Mobile Deposit?

To use Security National Bank's Mobile Checking Deposit feature, you must have four things:

- An eligible checking or savings account with SNB (most accounts are automatically eligible).

- An online banking login.

- The SNB SD Mobile App downloaded to your mobile device.

- A mobile device equipped with an auto-focus camera (or the check deposit menu will not function).

Some account restrictions apply. Please contact us if you have questions regarding account eligibility.

The account I want to use for my deposit is not listed in the options. What do I do?

In most cases, eligible accounts will automatically be signed up for Mobile Deposit. If the account you wish to use for the deposit does not appear on the list, it may not be eligible to receive mobile deposits. Contact us to speak to an SNB customer service representative and determine the issue.

What types of checks can I deposit with Mobile Deposit?

Most domestic checks and U.S. Treasury checks can be processed through Mobile Deposit. We are unable to accept the following:

- Money Orders

- Foreign Items

- Savings Bonds

- Third Party Checks

Are there any limits on the dollar amount and number of deposits I can submit?

The SNB SD Mobile App will not allow you to make a deposit greater than $2,500.

The daily limit is also $7,500 or 10 deposits per depositor (not account). This limit is based on approvals, not submissions.

There is also a multi-day limit of $15,000 or 200 deposits per depositors, over a period of 20 business days.

Can I photograph more than one check at a time?

No, you may only photograph one check per deposit.

How do I endorse my check for Mobile Deposit?

You should sign your check with the following endorsement:

First/Last Name Signature

"For Mobile Deposit at

Security National Bank only"

How will I know if SNB received and processed my deposit?

You will receive a notification by e-mail when your deposit has been received.

Once your deposit is received, you will receive a second e-mail notification regarding the status of your deposit. This e-mail will indicate if the deposit was approved or declined for processing. If declined, a reason will be provided.

If there is any problem with with the verification of your deposit, you will receive an email from Security National Bank.

When will my deposit post to my account?

Deposits can be made with Mobile Deposit at any time, however check deposits are subject to verification and not available for immediate withdrawal.

Any deposit received after 4 p.m. from Monday through Friday will be processed the next business day (excluding holidays) — unless a hold is applied.

If a deposit is held (or a hold is applied), funds are posted to your account but not immediately available for debits or withdrawals.

What if the check image I photographed is bad?

You have the option to retake photographs of the check before submitting or you may cancel the deposit. Be sure to place your check on a flat surface with a dark background and good lighting.

If you are unable to photograph a clear image, please mail or deposit the check at your nearest SNB location.

What should I do with my check after I deposit it?

Keep the check until you receive the email confirmation that your deposit has been approved, and you can verify the deposit to your account. Once you receive the email confirmation and verify the deposit to your account, you should destroy and dispose of the physical check.

What if I submitted a deposit for the wrong amount?

You do not need to resubmit your deposit. After the check clears, you can then transfer the funds to the correct account using online banking, the SNB SD Mobile App or in person at the nearest SNB location. If your deposit needs to be resubmitted, you will be notified by Security National Bank.

What if I submit the same deposit twice in error?

If the same deposit is submitted twice, it will be identified and stopped by our processing. Should this occur, you will receive a declined deposit notification for the second deposit.

A check I submitted was returned, can I resubmit it?

If a deposit is returned, please do not re-deposit the check with the Mobile Deposit functionality. You will receive written communication from the bank through the US Postal Service if a deposit is returned.

Can I see my Mobile Deposit history?

Yes. To access, select the “Recent” option on the bottom SNB SD Mobile App menu. Here, you can access a chronological list of all your historical transactions. Selecting an individual deposit will provide even further details including dates, amounts, processing status and check images.

Is there a fee for using mobile deposit?

There are no fees for SNB customers to use the SNB SD Mobile App or Mobile Deposits. However, some SNB accounts may incur general fees that are unrelated to the Mobile App. Also, you may want to check with your wireless provider about carrier and web access charges.

What if my question isn't on this page?

For more information, or if you have additional questions, call our customer care center at (605) 977-9000 in Sioux Falls, (712) 277-6500 in Dakota Dunes, or contact us online.

Contact Us